.png)

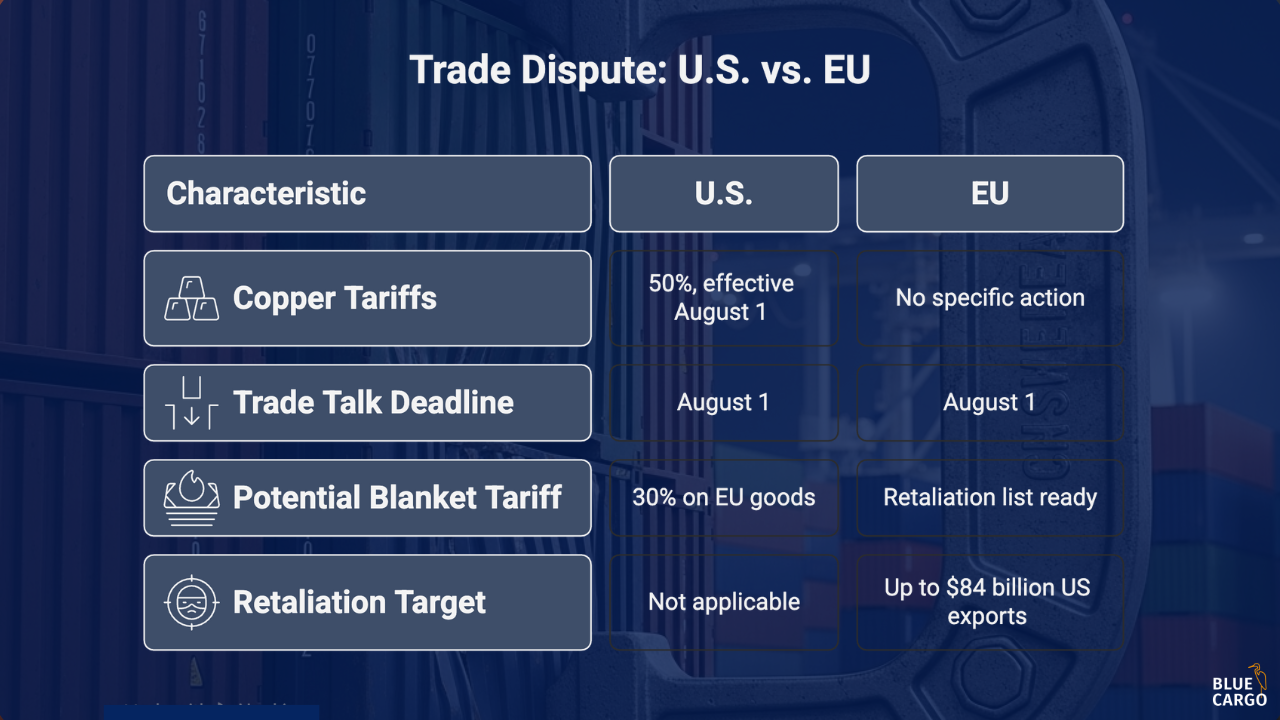

A convergence of trade policy deadlines and new duties is creating an immediate and complex challenge for U.S. importers. With an August 1st "hard deadline" for a U.S.-EU trade deal and a new 50% tariff on copper now active, supply chain leaders must shift from monitoring to immediate action.

The August Tariff Situation at a Glance:

1. What’s Official Now

- U.S. Copper Tariffs: Confirmed at 50%, effective August 1.

- EU Trade Talks: The U.S. has set a hard August 1st deadline. If no deal is reached, a 30% blanket tariff could apply to all goods originating from the EU.

- EU Retaliation: A retaliation list is ready, targeting up to €72 billion ($84 billion) of U.S. exports, including cars, machinery, and agricultural products.

2. The Numbers That Matter

- Trade at Risk: Over $5 billion in goods and services are traded daily between the U.S. and EU.

- Copper Price Shock: U.S. (COMEX) prices have spiked, trading at an unprecedented 25% premium over the London Metal Exchange (LME).

- Landed Cost Impact: A 30% tariff on a container of goods valued at $30,000 in cost, destroying profitability.

3. The Core Supply Chain Reality

The window for front-loading cargo to avoid these tariffs has largely closed. The focus must now shift to managing the costs and delays of goods arriving under the new tariff regimes.

Reading the Market: The Arbitrage Signals Are Clear

Financial markets have already priced in significant disruption. The most telling indicator has been in the copper market, where the spread between the New York (COMEX) and London (LME) exchanges surged to an unprecedented 25% premium. This isn't just a number; it's a massive arbitrage signal that has driven a "great race" to land copper on U.S. shores before the tariff hammer fell.

This behavior, known as front-loading inventory to lock in lower costs, has been widespread, with importers rushing shipments to meet deadlines. This has led to surges in container volumes, putting pressure on port operations and chassis availability. The key takeaway for Directors of Supply Chain is that the market is already volatile. Any decisions made now are made in an environment of heightened demand for logistics services and shrinking capacity.

The Director's Playbook: Key Decisions for July 21st – August 5th

1. Cargo in Transit: The "On the Water" Dilemma

Any cargo from the EU or copper shipments set to arrive around the August 1st deadline is now at high risk. U.S. Customs and Border Protection (CBP) policy is clear: the tariff rate is determined by the date of entry, not the date of lading. A two-day delay at anchorage due to port congestion could be the difference between a 10% and a 30-50% duty.

-> Triage all in-transit shipments. Work with your customs broker and freight forwarder to get real-time ETAs. For high-value shipments, evaluate the cost of expediting inland transit versus the potential tariff increase.

2. Port and Customs Execution: The Bottleneck is Real

Tariff deadlines invariably create port congestion and customs bottlenecks. The rush to beat the clock on previous deadlines led to record throughput, followed by yard congestion and berthing delays. This time will be no different.

-> Operational Risk:

CBP will be scrutinizing documentation more closely. An increase in customs holds, even for minor paperwork errors on the Commercial Invoice or ISF, is likely. Customs brokers are managing a surge in filings, which increases the potential for mistakes and delays.

Container dwell times at terminals are already reported to be on the rise.

-> Contact your customs broker:

Confirm that all paperwork for the arriving cargo is complete and accurate. Do not wait for the vessel to arrive.

Proactively book drayage and chassis services, as availability is expected to be tight. Avoid relying on same-day appointments, as they may be unavailable.

3. Financial and Sourcing Decisions: The Landed Cost Imperative

A 30% tariff on a container of European goods valued at $100,000 adds an immediate $30,000 in cost, wiping out the projected margin.

- Critical Question: For cargo that has not yet shipped, the decision is stark: do you ship and absorb a catastrophic cost, or do you cancel/postpone the order? This requires immediate collaboration with your finance, sales, and executive teams.

- Action Item: Implement a tariff surcharge strategy immediately. You must have transparent conversations with suppliers and customers about how these new costs will be shared. Waiting until the invoice arrives is too late. Explore alternative sourcing options, but be aware that shifting supply chains quickly is a complex, long-term process.

Financial Resilience Partner in the Chaos

The coming weeks will be defined by freight rate volatility, unpredictable demurrage and detention fees from port delays, and complex compliance challenges.

You cannot afford billing errors or cost anomalies in this environment. BlueCargo's AI-powered audit platform is designed for this chaos, helping you audit every single charge, identify cost-saving opportunities, and maintain financial control when every dollar matters.

👉 Worried about how these tariffs will blow up your budget? We want to work with you on your savings! Schedule a 15-minute audit consultation to discover how we can assist you.