US Trade and Tariff Update: July 2025 Overview

U.S. trade policy just took another sharp turn. A mix of extended reciprocal tariffs, targeted country deals, and expanded enforcement mechanisms is reshaping how goods move across borders. For global shippers, this isn’t just political theater, it’s operational reality.

Here’s what’s changed, what’s coming, and what you can do right now to stay ahead.

🔁 1. Reciprocal Tariffs Extended Through August

On July 9, President Trump signed an Executive Order extending reciprocal tariff adjustments through:

- August 1 for non-China countries

- August 12 for China

Under this policy, U.S. tariffs are now calibrated to match the rates charged by other countries for American goods. While branded as “fair,” this approach has raised rates for most nations to 15–25%.

⚠️ But that’s not the ceiling:

Several countries, including Bangladesh, Cambodia, and Brazil, are now facing rates of 30% to 34%, depending on the product category and prior trade barriers. Flexport Tariffs Update….

📌 Between July 7 and 12, 25 formal letters were posted via Truth Social, outlining the specifics for each country. The final batch targeted Canada, Mexico, and the EU, indicating continued tension even with major trading partners.

🤝 2. Key Trade Agreements That Matter for Shippers

If you're sourcing from, exporting to, or transshipping through any of these countries, your cost structure may change, soon.

⚠️ 3. Section 232 Expands Beyond Metals

The U.S. government is rapidly broadening the scope of Section 232 national security investigations, which allow the President to impose tariffs if imports are deemed a threat to national security.

Currently active or newly launched investigations include:

- 🧪 Semiconductors

- 💊 Pharmaceuticals

- ✈️ Jet engines and commercial aircraft

- 🛩️ Unmanned aircraft (drones)

- 🪵 Timber and lumber

- ⚙️ Copper

The original 232 tariffs, including 50% on steel and aluminum, and 25% on autos, remain in full effect.

📌 Implication: Even if your category isn’t under investigation today, the list is growing. Proactive risk assessments are now essential.

📜 4. “One Big Beautiful Bill”

Beyond executive orders, a sweeping bill has been proposed to restructure trade enforcement and boost domestic production. It includes:

🔍 De Minimis Rule Ends July 2027

- Applies to all countries

- Fines: $5,000 (1st violation), $10,000 (subsequent) for commercial misdeclarations

- Personal goods excluded

💸 $11B in Customs & Manufacturing Incentives

- $4B for CBP hiring

- $5B for new inspection equipment

- $2B for retention and bonuses

- 100% bonus depreciation for new equipment/facilities

- Expanded interest deductions for supply chain-related investments

- Special tax incentives for semiconductor production

📌 Bottom line: This bill ties together enforcement, tax reform, and industrial strategy. Shippers and manufacturers alike will feel the effectsFlexport Tariffs Update….

📉 5. Europe in Limbo: 30% Tariffs Loom as Deal Hangs by a Thread

The European Union is racing to avoid sweeping U.S. tariffs, but with August 1 approaching fast, the outcome remains uncertain.

President Trump has threatened to impose 30% across-the-board tariffs on EU imports, citing longstanding trade imbalances and disputes over digital regulation. European officials, caught off guard by a July 11 letter from Trump, are now urgently negotiating in Washington, but U.S. officials, including Treasury Secretary Scott Bessent, have publicly signaled indifference to the outcome, calling it a “generational opportunity to reset trade.”

⚠️ Implications for U.S. Importers

- Auto parts, machinery, wine, and specialty foods from Europe could soon be significantly more expensive.

- Retailers and manufacturers that rely on EU suppliers may need to restructure their contracts or seek alternative sourcing quickly.

⚠️ Implications for U.S. Exporters

- If negotiations fail, the EU is prepared to retaliate, likely targeting American energy, tech, and agricultural products, creating friction for exporters just as harvest and holiday shipping seasons approach.

Despite ongoing efforts by EU Trade Commissioner Maros Sefcovic, a deal appears elusive.

While Europe was prepared to accept a 10% tariff baseline with product-level exceptions, the U.S. is now holding out for more aggressive concessions, particularly around digital regulation and tech governance, which Brussels has refused to change.

“I don’t think there’s this magic [solution],” said Jörn Fleck of the Atlantic Council. “I think it’s in the Trump administration’s hands.”

As of mid-July, importers and exporters on both sides of the Atlantic are operating in a climate of uncertainty, where pricing, delivery timelines, and margin assumptions may shift with little notice.

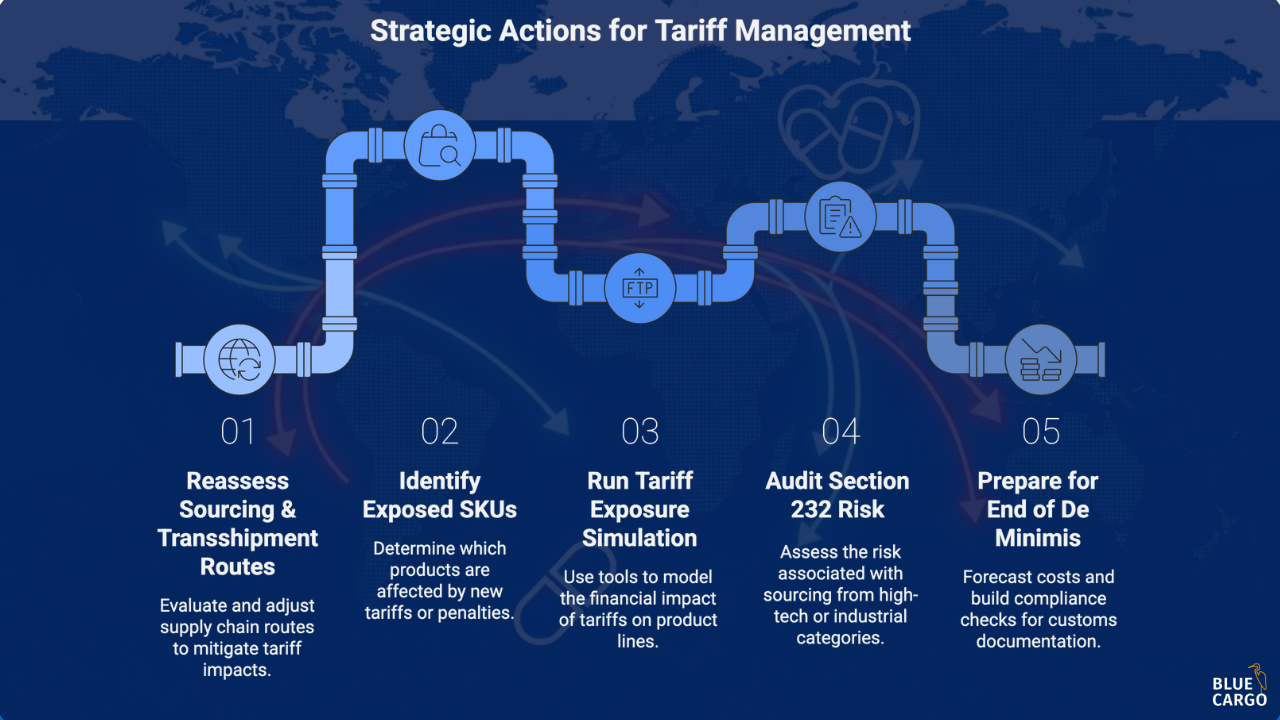

✅ What Should You Do Right Now?

To remain competitive and compliant amidst these rapid changes, logistics and trade leaders should take action on the following:

- Reassess Sourcing & Transshipment Routes

- Identify SKUs exposed to new reciprocal tariffs or BRICS penalties.

- Run a Tariff Exposure Simulation

- Use tools like ACE or Flexport’s Tariff Simulator to model financial impact across product linesFlexport Tariffs Update….

- Audit Section 232 Risk Across Categories

- Pay close attention to new investigations, especially if you source from high-tech or industrial categories.

- Prepare for the End of De Minimis

- Forecast costs under the new penalties and build compliance checks into customs documentation workflows.

🛑 The Cost of Standing Still

.png)

Due to changing tariff bands, stalled negotiations, and stricter enforcement across various categories, supply chain leaders need more than just alerts; they need a practical plan.

Now is the time to unite trade compliance, finance, and operations.

Companies that take this step will be better equipped to adapt and protect their profit margins. Those that do not will face costs beyond just tariffs.

----

Want to explore how AI-driven audit tools can help you manage tariff volatility?

📅 Book a quick strategy session with our customs specialists →